June 2023 On The Money Newsletter

- by Rebecca Gray

- June 30, 2023

- Superannuation tax management Bookkeeping business startup

2023-24 Federal Budget Highlights

The 2023-24 Federal Budget was released by Jim Chalmers, the Federal Treasurer, on the 9th May 2023. The main aim was to provide help to everyday Australians who are suffering from the large cost of living increases experienced by us all over the past twelve to eighteen months. Cost increases that will continue until inflation is brought under control.

The 2023-24 Federal Budget was released by Jim Chalmers, the Federal Treasurer, on the 9th May 2023. The main aim was to provide help to everyday Australians who are suffering from the large cost of living increases experienced by us all over the past twelve to eighteen months. Cost increases that will continue until inflation is brought under control.

Small businesses need to be on their toes because along with (tax payer-related) initiatives there will be funding for the ATO and other government agencies to ensure compliance with all tax matters. Included in the Budget are allocations for areas such as:

- Funding will be provided to the ATO over 4 years to lower the tax-related administrative burden for small and medium businesses, cut paperwork and reduce time small businesses spend doing taxes.

- Funding for GST compliance will be extended for a further 4 years to address emerging risks to GST revenue.

The following is a run-down of the main changes contained in the Budget. Some will impact on more of us than others and for these some extra detail has been included.

Individuals

- Income support payment base rates will be increased by $40 per fortnight. The increase will apply to JobSeeker Payment, Youth Allowance, Parenting Payment (Partnered), Austudy, Abstudy, Disability Support Pension (Youth) and Special Benefit from 20 September 2023.

- The minimum age at which older people qualify for the higher JobSeeker Payment rate will be reduced from 60 to 55 years. This applies to those who have received the payment for 9 or more continuous months. Eligible recipients will receive an increase in their base rate of payment of $92.10 per fortnight.

- The workforce participation incentive measures to support pensioners who want to work without impacting their pension payments will be extended for another 6 months to 31 December 2023. Originally announced in the Labor government’s 2022–23 Budget, the measure provides age and veterans pensioners a once-off credit of $4,000 to their Work Bonus income bank and temporarily increases the maximum income bank. Under this measure, pensioners can earn up to $11,800 before their pension is reduced.

- Eligibility for Parenting Payment (Single) will be extended to support single principal carers

with a youngest child under 14 years of age. - A number of measures will be introduced to increase support for social and affordable housing and improve access for home buyers.

- The maximum rates of the Commonwealth Rent Assistance (CRA) allowances will be increased by 15% to help address rental affordability challenges for CRA recipients.

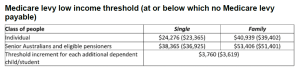

- CPI indexed Medicare levy low-income threshold amounts for singles, families, and seniors and pensioners for the 2022–23 year were announced.

- Eligible lump sum payments in arrears will be exempt from the Medicare levy from 1 July 2024.

Small & Medium Business

- The instant asset write-off threshold for small businesses applying the simplified depreciation rules will be $20,000 for the 2023–24 income year.

- Small businesses (aggregated annual turnover less than $10 million). The measure will apply a $20,000 threshold for the instant write-off, applicable to eligible assets costing less than $20,000 first used or installed between 1 July 2023 and 30 June 2024. The $20,000 threshold will apply on a per-asset basis, so small businesses can immediately write-off multiple low-cost assets. The threshold had been suspended during the operation of temporary full expensing from 6 October 2020 to 30 June 2023.

Assets costing $20,000 or more will continue to be placed into a small business depreciation pool under the existing rules.

The provisions that prevent a small business entity from choosing to apply the simplified depreciation rules for 5 years after opting-out will continue to be suspended until 30 June 2024. - An additional 20% deduction will be available for small and medium business expenditure supporting electrification and energy efficiency.

The additional deduction will be available to businesses with aggregated annual turnover of less than $50 million. Eligible expenditure may include the cost of eligible depreciating assets, as well as upgrades to existing assets, that support electrification and more efficient use of energy. Certain exclusions will apply, including for electric vehicles, renewable electricity generation assets, capital works, and assets not connected to the electricity grid that use fossil fuels.

Examples of expenditure where the measure applies include:

o assets that upgrade to more efficient electrical goods (eg energy-efficient fridges)

o assets that upgrade to more efficient electrical goods (eg energy-efficient fridges)

o assets that support electrification (eg heat pumps and electric heating or cooling systems), and

o demand management assets (eg batteries or thermal energy storage).

Total eligible expenditure for the measure will be capped at $100,000, with a maximum additional deduction available of $20,000 per business.

When enacted, the measure will apply to eligible assets or upgrades first used or installed and ready for use between 1 July 2023 and 30 June 2024. Full details of eligibility criteria will be finalised in consultation with stakeholders.

- FBT exemption for eligible plug-in hybrid electric cars will end from 1 April 2025. Arrangements involving plug-in hybrid electric cars entered into between 1 July 2022 and 31 March 2025 remain eligible for the exemption.

- An increased capital works deduction rate and reduced withholding on managed investment trust (MIT) payments will apply to new build-to-rent projects.

- The clean building managed investment trust (MIT) withholding tax concession will be extended from 1 July 2025 to eligible data centres and warehouses, where construction commences after 7:30 pm (AEST) on 9 May 2023.

- The start date of a measure to prevent franked distributions funded by certain capital raisings announced in the 2016–17 Mid-Year Economic and Fiscal Outlook has been postponed from 19 December 2016 to 15 September 2022.

- The introduction of tradeable biodiversity stewardship certificates issued under the Agriculture Biodiversity Stewardship Market scheme will be delayed to 1 July 2024.

- The Location Offset rebate and the Qualifying Australian Production Expenditure thresholds will be increased to boost investment in film production in Australia.

- Deductible gift recipients list to be updated.

Superannuation

Reducing tax concessions for superannuation balances exceeding $3 million

Superannuation earnings tax concessions will be reduced for individuals with total superannuation balances in excess of $3 million.

From 1 July 2025, earnings on balances exceeding $3 million will incur a higher concessional tax rate of 30% (up from 15%) for earnings corresponding to the proportion of an individual’s total superannuation balance that is greater than $3 million. The change does not impose a limit on the size of superannuation account balances in the accumulation phase and it applies to future earnings, ie it is not retrospective.

Earnings relating to assets below the $3 million threshold will continue to be taxed at 15%, or zero if held in a retirement pension account.

Interests in defined benefit schemes will be appropriately valued and will have earnings taxed under this measure in a similar way to other interests.

Employers to be required to pay super guarantee on payday

Employers will be required to pay their employees’ superannuation guarantee (SG) entitlements at the same time as they pay their salary and wages from 1 July 2026.

Employers are currently required to make SG contributions for an employee on a quarterly basis to avoid incurring a superannuation guarantee charge.

The proposed commencement date of 1 July 2026 is intended to provide employers, superannuation funds, payroll providers and other stakeholders sufficient time to prepare for the change.

Changes to the design of the superannuation guarantee charge will also be required to align with the increased payment frequency. The government will consult with relevant stakeholders on the design of these changes, with the final framework to be considered as part of the 2024–25 Budget.

In addition, funding will be provided to the ATO to, among other things, improve data-matching capabilities to identify and act on cases of SG underpayment.

Sources: Budget Paper No 2, p 26; Budget Factsheet — Stronger foundations for a better future, p 62; Assistant Treasurer’s press release “Introducing payday super”, 2 May 2023.

Non-arm’s length income (NALI) amendments

Non-arm’s length income (NALI) amendments

The non-arm’s length income (NALI) measure announced by the Coalition government in 2022 will be amended to provide greater certainty to taxpayers.

On 24 January 2023, Treasury released a consultation paper on the following potential amendments to the NALI provisions:

- self-managed superannuation funds (SMSFs) and small APRA funds would be subject to a factor-based approach which would set an upper limit on the amount of fund income taxable as NALI due to a general expenses breach. The maximum amount of fund income taxable at the highest marginal rate would be 5 times the level of the general expenditure breach, calculated as the difference between the amount that would have been charged as an arm’s length expense and the amount that was actually charged to the fund. Where the product of 5 times the breach is greater than all fund income, all fund income will be taxed at the highest marginal rate, and

- large APRA-regulated funds would be exempted from the NALI provisions for general expenses of the fund.

To provide greater certainty to taxpayers, the NALI provisions which apply to expenditure incurred by superannuation funds will be amended by:

- Limiting income of SMSFs and small APRA regulated funds that are taxable as NALI to twice the level of a general expense.

- Additionally, fund income taxable as NALI will exclude contributions.

- Exempting large APRA regulated funds from the NALI provisions for both general and specific expenses of the fund, and

- Exempting expenditure that occurred prior to the 2018–19 income year.

2023 Year End Tax Planning Guide

As we approach the end of the 2023 financial year, tax planning has never been more important and as accountants, we believe our client brief includes helping you minimise your tax liability within the framework of the Australian taxation system. The purpose of this newsletter is to highlight some end-of-year tax planning opportunities, but you need to be proactive and act quickly to take advantage of these strategies. We encourage you to schedule a meeting with us as soon as possible to assess your tax planning options.

As we approach the end of the 2023 financial year, tax planning has never been more important and as accountants, we believe our client brief includes helping you minimise your tax liability within the framework of the Australian taxation system. The purpose of this newsletter is to highlight some end-of-year tax planning opportunities, but you need to be proactive and act quickly to take advantage of these strategies. We encourage you to schedule a meeting with us as soon as possible to assess your tax planning options.

To assist you we have put together a list of strategies to consider and note:

- To maximise benefits for the current financial year, we suggest you prepare a preliminary calculation of your taxable income for the year ending June 30, 2023, to identify the size of your likely tax debt and

determine whether you might have a tax ‘problem’. - Review all tax-deductible expenses and assessable income in the latest available figures to

determine the possibility of pre-paying some expenses before June 30 or deferring some revenue until after July 1.

The following list of tax planning opportunities is certainly not exhaustive and depending on your circumstances (including your turnover and whether you are on a cash or accruals method of accounting), terms and conditions may apply to some of these tactics. If you would like to discuss your tax planning options we urge you to contact us today, and most importantly, don’t leave it until the last minute as some of these strategies require some time to implement.

Key Tax Minimisation Strategies

CONSIDER THE FOLLOWING OPPORTUNITIES

1. Delay Deriving Assessable Income

One effective strategy is to delay deriving your income until after June 30, 2023 by:

a. Delaying the Timing of the Derivation of Income until after June 30.

b. Timing of Raising Invoices for Incomplete Work (Businesses)

Where this strategy will not adversely affect your cash flow, consideration should be given to deferring the recognition of income until after 30 June 2023. Please note, not banking amounts received before June 30 until after June 30 does NOT qualify because the income is deemed to have been earned when the money is received, or the goods or services are provided (depending on whether you are on a cash or accruals basis of accounting).

• Cash Basis Income – Some income is taxable on a cash receipts basis rather than on an accrual basis (e.g. rental income or interest income in certain cases). You should consider whether some income can be deferred in those instances.

• Consider delaying your invoices to customers until after July 1, which will push the derivation of the income into the next financial year and defer the tax payable on that income. If you operate on the cash basis of accounting, you simply need to delay receiving the money from your customers until after June 30.

• Lump Sum Amounts – Where a lump sum is likely to be received close to the end of a financial year, you should consider whether this amount (or part thereof) can be delayed or spread over future periods.

2. Bringing Forward Deductible Expenses or Losses

Prepayment of Expenses – In some circumstances, Small Business Entities (SBE) and individuals who derive passive type income (such as rental income and dividends) should consider pre-paying expenses prior to 30 June 2023. A tax deduction can be brought forward into this financial year for expenses like:

- Employee Superannuation Payments including the 10.5% Superannuation Guarantee Contributions for the June 2023 quarter (that have to be received by the Superannuation Fund by June 30, 2023 to claim a tax deduction).

- Superannuation for Business Owners, Directors and Associated Persons.

Wages, bonuses, commissions and allowances

Wages, bonuses, commissions and allowances- Contractor Payments

- Travel and accommodation expenses

- Trade creditors

- Rent for July 2023 (and possibly future additional months)

- Insurances including Income Protection Insurance

- Printing, Stationery and Office Supplies

- Advertising including Directory Listings

- Utility Expenses – Telephone, Electricity & Gas

- Motor Vehicle Expenses – Registration and Insurance

- Accounting Fees

- Subscriptions and Memberships to Professional Associations and Trade Journals

- Repairs and Maintenance to Investment Properties

- Self Education Costs

- Home Office Expenses – deductible gift recipient.

- Donations to Deductible Gift Recipient organizations

- If appropriate, consider prepaying any deductible investment loan interest. This could include interest payments on an investment loan for either an investment or commercial property or an investment portfolio you hold.

A deduction for prepaid expenses will generally be allowed where the payment is made before 30 June 2023 for services to be rendered within a 12-month period. While this strategy can be effective for businesses operating on a cash basis (not accruals basis), we never recommend you spend money on items you don’t need. Of course, this only works if you have sufficient cash-flow.

Superannuation Contributions – some low or middle-income earners who make personal (after-tax) contributions to a superannuation fund may be entitled to the government co-contribution. The amount of government co-contribution will depend on your income and how much you contribute. (Refer to the Superannuation Section for more information).

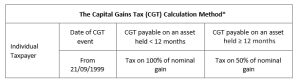

Capital Gains/Losses – Note that the contract date (not the settlement date) is often the key sale date for capital gains tax purposes, and when it comes to the sale of an asset that triggers a capital gain or capital loss, you need to consider your overall investment strategy when making the decision to sell. Here are some important points regarding the management of capital gains and capital losses on sale of your assets from a tax planning perspective:

Capital Gains/Losses – Note that the contract date (not the settlement date) is often the key sale date for capital gains tax purposes, and when it comes to the sale of an asset that triggers a capital gain or capital loss, you need to consider your overall investment strategy when making the decision to sell. Here are some important points regarding the management of capital gains and capital losses on sale of your assets from a tax planning perspective:

i. If appropriate, consider deferring the sale of an asset with an expected capital gain (and applicable capital gains tax liability) until it has been held for 12 months or longer. By doing so, you could reduce your personal income tax. For example, if you hold an asset for under 12 months, any capital gain you make may be assessed in its entirety upon the sale of that asset.

ii. * A capital gain will be assessable in the financial year it is crystallised.

iii. If appropriate, consider deferring the sale of an asset with an expected capital gain (and applicable capital gains tax liability) to a future financial year. By doing this, you could help reduce your personal income tax for the current financial year. This could also be of benefit if, for example, you expect that your income will be lower in future financial years compared to the current financial year.

iv. If appropriate, consider offsetting a crystallised capital gain with an existing capital loss (carried forward or otherwise) or bringing forward the sale of an asset currently sitting at a loss. By doing this, you could reduce your personal income tax for the current financial year. Note that a capital loss can only be used to offset a capital gain.

Accounts Payable (Creditors) – If you operate on an accruals basis and services have been provided to your business, ensure that you have an invoice dated June 30, 2023 or before, so you can take up the expense in your accounts for the year ended 30th June 2023.

Obligations that need to be considered in relation to the end of financial year.

If you use a Motor Vehicle in producing your income you may need to:

If you use a Motor Vehicle in producing your income you may need to:

- Record Motor Vehicle Odometer readings at 30 June 2023

- Prepare a log book for 12 continuous weeks if your existing one is more than 5 years old.

If you are in business or earn your income through a Company or Trust:

Employer Compulsory Superannuation Obligations:

The deadline for employers to pay Superannuation Guarantee Contributions for the 2022/23 financial year is the 28 July 2023. However, if you want to claim a tax deduction in the 2022/23 tax year the super fund (or Small Business Superannuation Clearing House) must receive the contributions by 30 June 2023. Avoid making contributions at the last minute because processing delays could deny you a significant tax deduction in this financial year.

- For Private Company – Div 7A Loans – Business owners who have borrowed funds from their company in prior years must ensure that the appropriate principal and interest loan repayments are made by 30 June 2023.

- Trustee Resolutions – ensure that the Trustee Resolutions on how the income from the

trust is distributed to the beneficiaries are prepared and signed before June 30, 2023 for all Discretionary (“Family”) Trusts. - Preparation of Stock Count Working Papers at June 30, 2023.

- Preparation and reconciliation of Employee PAYG Payment Summaries (formerly known as Group Certificates). Note you are not required to supply your employees with payment summaries for amounts you have reported and finalised through Single Touch Payroll.

From 1 July 2023:

From 1 July 2023:

The compulsory Super Guarantee Contribution rate increases from 10.5 % to 11% from July 1, 2023. Company Tax Rates For Small Business

- The company tax rate for base rate entities with less than $50 million turnover was 25% for the 2021/22 year. This rate will remain at 25% for 2022/23 income year. A base rate entity is a company that both has an aggregated turnover less than the aggregated turnover threshold and 80% or less of their assessable income is base rate entity passive income.

Other Tax effective Strategies For Businesses

THE FOLLOWING SHOULD ALSO BE CONSIDERED

Stock Valuation Options – Review your Stock on Hand and Work in Progress listings before June 30 to ensure that it is valued at the lower of Cost or Net Realisable Value. Any stock that is carried at a value higher than you could realise on sale (after all costs associated with the sale) should be written down to that Net Realisable Value in your stock records.

Stock Valuation Options – Review your Stock on Hand and Work in Progress listings before June 30 to ensure that it is valued at the lower of Cost or Net Realisable Value. Any stock that is carried at a value higher than you could realise on sale (after all costs associated with the sale) should be written down to that Net Realisable Value in your stock records.- Compulsory Superannuation Guarantee – As mentioned in Tax Minimisation Strategies, if you want a tax deduction in the 2022/23 financial year, the superannuation fund must receive the funds by 30 June 2023. The Tax Office doesn’t consider a contribution to be made until the amount is actually credited to a super fund’s bank account so an electronic transfer to another bank account on June 30 is not necessarily considered paid. We strongly recommend you make the payment a week or so before June 30 and then follow up with the super fund to ensure the funds have been received. Don’t risk the tax-deductibility of what can often be a significant amount by leaving payment to the last minute.

- Write-Off Bad Debts – If you operate on an accruals basis of accounting (as distinct from a cash basis) you should write-off bad debts from your debtors listing before June 30. A bad debt is an amount that is owed to you that you consider is uncollectable or not economically feasible to pursue collection. Unless these debts are physically recorded as a ‘bad debt’ in your system before 30th June 2023, a deduction will not be allowable in the current financial year.

- Repairs and Maintenance Costs – Where possible and cash flow allows, consider bringing these repairs forward to before June 30. If you don’t understand the distinction between a repair and a capital improvement please consult with us because some capital improvements may not be tax-deductible in the current year and could be claimable over a number of years as depreciation.

- Obsolete Plant and Equipment – should be scrapped or decommissioned prior to June 30, 2023 to enable the book value to be claimed as a tax deduction.

- Also see Small Business Write-Off for Individual Assets

- Also see Company Loss Carry Back Offset from our Budget 2022-23 Round Up

- Use of a Bucket Company to receive distributions from your Discretionary Trust

Superannuation Tax Planning Opportunities

INCREASE IN SUPER GUARANTEE CONTRIBUTION RATE

From July 1, 2023 the compulsory Super Guarantee Contribution rate increases from 10.5 % to 11%. The rate will increase again to 11.5% from July 1, 2024 to 12% from July 1, 2025.

The maximum super contribution base used to determine the maximum limit on any individual employee’s earnings base for each quarter of 2022/22 is $58,920 and for 2022/23 is $60,220 per quarter. You do not have to provide the minimum support for the part of earnings above this limit.

CONCESSIONAL CONTRIBUTION CAP OF $27,500 FOR EVERYONE

The tax-deductible superannuation contribution limit or cap is $27,500 for all individuals regardless of their age for the 2022/23 financial year

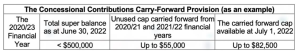

- If eligible and appropriate, consider making the most of your 2022/23 financial year annual concessional contributions cap with a concessional contribution. Note that other contributions such as employer Superannuation Guarantee Contributions (SGC) and salary sacrifice contributions will have already used up part of your concessional contributions cap. If your total superannuation balance as at June 30, 2022 was less than $500,000 you may be in a position to carry-forward unused concessional caps starting from the 2018/19 financial year. Members can access their unused concessional contributions caps on a rolling basis for five years and amounts carried forward that have not been used after five years will expire. The 2019/20 financial year was the first year in which you could access unused concessional contribution and by making a concessional contribution to your super, you could reduce your personal income tax for this financial year and provide for your future retirement.

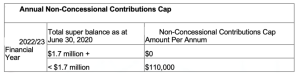

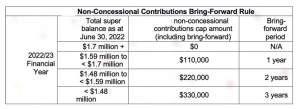

- If eligible and appropriate, consider utilizing all or part of your 2022/23 financial year annual non-concessional contributions cap by making a non-concessional contribution. If you are not currently in a non-concessional contributions bring forward period, consider whether you may be in a position to ‘bring-forward’ your non-concessional contributions caps for the 2023/24 and 2024/25 financial years, and contribute up to $330,000 for the 2022/23 financial year.

- A non-concessional contribution generally refers to an after-tax contribution that isn’t (or can’t be) claimed as a tax deduction by the contributor, e.g. personal contributions not claimed as a tax deduction and spouse contributions (for the recipient).

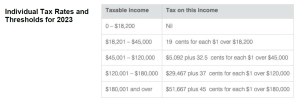

- The advantage of making the maximum tax-deductible superannuation contribution before June 30, 2023 is that superannuation contributions are taxed at between 15% and 30%, compared to personal tax rates of between 32.5% and 45% (plus 2% Medicare levy) for an individual taxpayer earning over $45,000. Typically, self-employed individuals and those who earn their income primarily from passive sources like investments make their super contributions close to the end of the financial year to claim a tax deduction. However, individuals who are employees may also use this strategy and those who might want to take advantage of this opportunity would typically include individuals:

o who work for an employer that does not permit salary sacrifice,

o who work for an employer that does enable salary sacrifice (but it is not disadvantageous due to a reduction in entitlements), and

o who are salary sacrificing but want to make a top-up contribution to utilise their full concessional contributions cap.

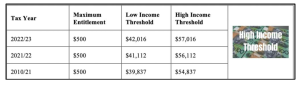

GOVERNMENT CO-CONTRIBUTION TO YOUR SUPERANNUATION

The Government co-contribution is designed to boost the superannuation savings of low and middle-income earners who earn at least 10% of their income from employment or running a business. If your income is within the thresholds listed in the table below and you make a ‘non-concessional contribution’ to your superannuation, you may be eligible for a Government co-contribution of up to $500. To be eligible you must be under 71 years of age as at June 30, 2022. In 2022/23, the maximum co-contribution is available if you contribute $1,000 and earn $42,016 or less. A lower amount may be received if you contribute less than $1,000 and/or earn between $42,016 and $57,016.

- The matching rate is 50% of your contribution and additional eligibility requirements were added from 1 July 2017 which include:

- Having a total superannuation balance of less than $1.7 million on 30 June of the year before the year the contributions are being made, and

- Having not exceeded your non-concessional contributions cap in the relevant financial year.

SALARY SACRIFICE TO SUPERANNUATION

If your marginal tax rate is 19% or more, salary sacrificing can be an effective way to boost your superannuation and also reduce your tax. By putting pre-tax salary into superannuation instead of having it taxed at your marginal tax rate you may save tax. This can be particularly beneficial for employees approaching retirement age. SELF-MANAGED SUPERANNUATION A Self-Managed Superannuation Fund (SMSF) can provide significant tax savings but they don’t suit everyone. There are significant regulations surrounding the management and administration of SMSFs. With the end of the financial year approaching, now is a good time to discuss the pros and cons of establishing your own SMSF. It might be appropriate to establish a SMSF in conjunction with other tax planning opportunities. If you would like more information about self-managed superannuation funds we invite you to consult with us today.

If your marginal tax rate is 19% or more, salary sacrificing can be an effective way to boost your superannuation and also reduce your tax. By putting pre-tax salary into superannuation instead of having it taxed at your marginal tax rate you may save tax. This can be particularly beneficial for employees approaching retirement age. SELF-MANAGED SUPERANNUATION A Self-Managed Superannuation Fund (SMSF) can provide significant tax savings but they don’t suit everyone. There are significant regulations surrounding the management and administration of SMSFs. With the end of the financial year approaching, now is a good time to discuss the pros and cons of establishing your own SMSF. It might be appropriate to establish a SMSF in conjunction with other tax planning opportunities. If you would like more information about self-managed superannuation funds we invite you to consult with us today.

MINIMUM PENSION PAYMENTS

- Certain superannuation pensions and annuities are subject to rules that determine minimum and maximum amounts to be paid in a financial year. A minimum amount must be paid each year for pensions or annuities as per the table below. There is no maximum amount, unless you are on a transition to retirement pension.

The minimum amount depends on age:

Under 65 is 2%

65 to 74 is 2.5%

75 to 79 is 3%

80 to 84 is 3.5%

Immediate Write-Off for Individuals Small Business Assets

Temporary Full Expensing allows businesses to claim an immediate deduction for the business portion of the cost of an asset being eligible plant, equipment and motor vehicles in the year it is first used or installed ready for use for a taxable purpose. For the 2022-23 income year, a business can claim an immediate deduction for the business portion of the cost of:

Temporary Full Expensing allows businesses to claim an immediate deduction for the business portion of the cost of an asset being eligible plant, equipment and motor vehicles in the year it is first used or installed ready for use for a taxable purpose. For the 2022-23 income year, a business can claim an immediate deduction for the business portion of the cost of:

- Eligible new assets first held, first used or installed and ready for use for a taxable purpose between 7.30pm AEDT on 6 October 2020 and 30 June 2023.

- Eligible second-hand assets for businesses with aggregated turnover under $50 million – eligible depreciating assets using the simplified depreciation rules (only for small businesses with aggregated turnover of less than $10 million and less than $2 million for previous income years) and the balance of their small business pool.

If you are a small business entity that chooses to use the simplified depreciation rules, temporary full expensing rules apply with some modifications.

You cannot opt out of temporary full expensing for assets that the simplified depreciation rules apply to. You must immediately deduct the business portion of the asset’s cost for assets you start to hold, and first use (or have installed ready for use) for a taxable purpose from 7.30pm (AEDT) on 6 October 2020 to 30 June 2023. You don’t add these assets to your small business pool.

You may also deduct the balance of the small business pool at the end of an income year ending between 6 October 2020 and 30 June 2023.

Here are some key points to consider:

- For the instant asset write-off the asset can be new or second-hand.

- To be eligible, the asset must be purchased by a business turning over less than $50m or $500 million after 12th March 2020.

- The amount must be under $150,000 (depending on date of purchase – it could be $30K or

$25K or $20K) exclusive of GST (i.e. $165,000, $33K, $27.5K or $22K including GST) - If you borrow to purchase the asset, the asset is still eligible.

- The asset must be installed and ready to use by the deadline.

- To claim the write off on a motor vehicle you will need to have a valid log book and claim only that percentage of the cost as an immediate write off.

- If you purchase a car for your business, the instant asset write-off is limited to the business portion of the car limit of $64,741 for the 2022/23 income tax year.

- Any attempt to manipulate invoices etc. will attract the ATO’s use of the anti-avoidance rules, thereby eliminating the write off.

If your business has a small profit or even a loss, the write off will be of little or no benefit in the current year (losses are not refundable but can be carried forward to the next year).

If your business has a small profit or even a loss, the write off will be of little or no benefit in the current year (losses are not refundable but can be carried forward to the next year).- Building structural improvements are not eligible for the instant write-off.

- If your business is not a ‘Small Business Entity’ you will need to depreciate all assets

purchased over $1,000. Any assets purchased for $1,000 or less can be written off immediately. - Accelerated Depreciation Deductions –Newly-acquired depreciating assets valued at more than $30,000 (or $150,000 post 12th March 2020) and not applied to the instant asset write-off deduction can be added to the general business pool. As part of the backing business incentive, an accelerated depreciation deduction of 57.5 percent for the business portion of the new depreciating asset applies for the cost of an asset on installation from 12th March 2020 to 30th June 2023 and existing depreciation rules apply (15 per cent for the first year and 30 per cent for subsequent years) to the balance of the asset’s cost and for subsequent years. There is no limit to the cost of a qualifying depreciating asset eligible for this concession, but the asset must be new and not second-hand.

Contact us today to help with your end of year tax planning.

Click here to download 2023 Tax Returns Client Checklist

IMPORTANT DISCLAIMER: This document contains general advice only and is prepared without taking into account your particular objectives, financial circumstances and needs. The information provided is not a substitute for legal, tax and financial product advice. Before making any decision based on this information, you should speak to a licensed financial advisor who should assess its relevance to your individual circumstances. While the firm believes the information is accurate, no warranty is given as to its accuracy and persons who rely on this information do so at their own risk. The information provided in this bulletin is not considered financial product advice for the purposes of the Corporations Act 2001.